This post provides a snapshot of my financial position as of 2025. I began documenting my financial journey in 2021, and every year since, I’ve written an annual letter to my future self—much like a CEO addressing shareholders. The previous letter was the Annual Letter 2024, and I’ll give you a spoiler: 2024 turned out to be a better year than 2025.

I hope this article adds value to your life, just as it does to my future self. My financial numbers and goals are personal and may not directly apply to you, but the underlying ideas are meant to be adapted. Please consider your own context—your country, financial position, and personality—when applying these insights.

1st of January 2026

Dear Future, Me,

This year, our portfolio, measured in euros, returned a modest 3.74%. The result appears weaker when compared with the S&P 500, which, measured in U.S. dollars, rose by nearly 16.65%. There are several reasons for this underperformance—including the fact that it is entirely normal and acceptable—which I will address later.

The portfolio’s current value stands at €163.4 thousand, representing an increase of more than €24.0 thousand, or over 15%, compared with the previous year.

Looking ahead, we expect future returns to improve; however, this may not materialise given today’s relatively high market valuations.

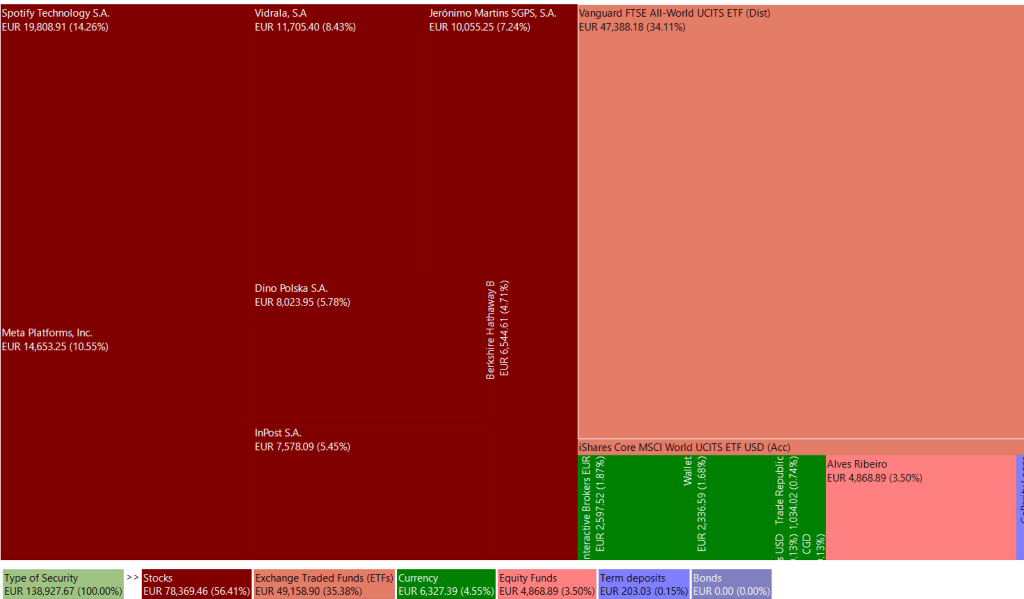

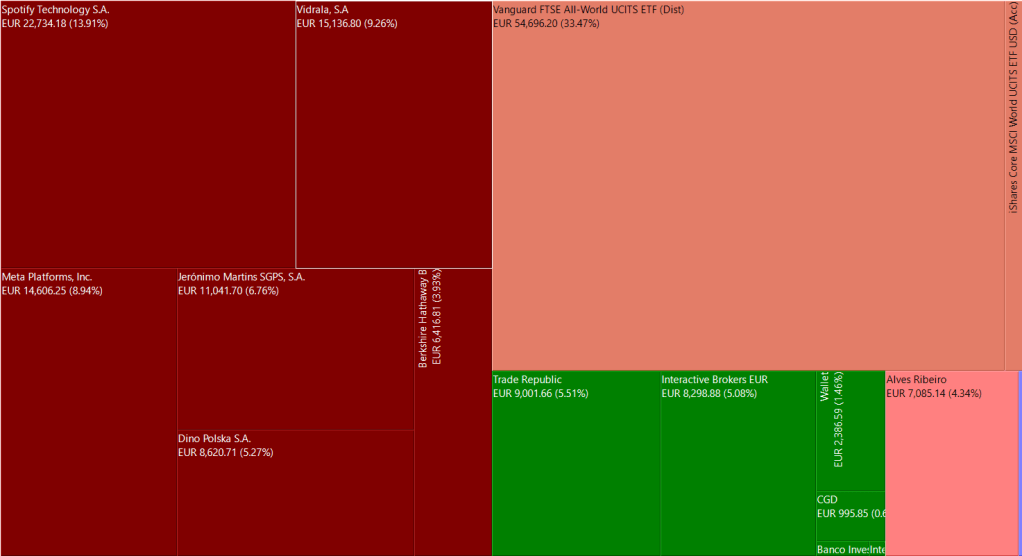

Portfolio asset allocation

The majority of our investments remain allocated to individual stocks, an approach that has delivered good results over the past years. This year, however, returns were positive but broadly flat, and this trend may persist in the medium term. The reasons are straightforward: mistakes happen, and investing in stocks relies on acquiring businesses at prices below their real value, and such opportunities arise infrequently. When they do, we are confident that we will be ready to act.

Over the past year, our cash position increased to approximately 12% of the portfolio. This level provides resilience and flexibility, allowing us to respond effectively to future opportunities. The remainder of the portfolio is invested in ETFs.

The table below presents the portfolio allocation by asset class.

| Assets | 2025 (%) | 2024 (%) |

| Individual Stocks | 48.05 | 56.41 |

| ETFs | 34.69 | 35.38 |

| Cash and equivalents | 12.81 | 4.55 |

| Equity and bond funds | 4.32 | 3.50 |

| Term deposits | 0.13 | 0.16 |

Current year’s results

Our previous reports have shown a portfolio growth of around 3.74%, measured in IRR. The top asset performance in 2025 continues to come from investments in ETFs and individual stocks. The return from the second group decreased significantly. The reasons behind this lower return are quite simple:

- On average, only a small subset of stocks delivers superior returns; statistically, the odds are against us.

- There are periods of underperformance, even for stocks that outperform over the long term.

- Mistakes matter—and yes, this year I made several, including an investment in InPost that directly cost us around 2.5%, excluding opportunity costs.

- I will always choose capital protection over outperformance.

To conclude, I do not know whether this underperformance is temporary or permanent, but I do believe there is a reasonable chance of achieving a good result in the long term.

The next table presents the portfolio’s top-performing assets.

| Assets | 2025 (%) | 2024 (%) |

| ETFs | 8.11 | 25.55 |

| Individual Stocks | 1.51 | 39.53 |

The table below outlines the composition of the portfolio, excluding cash and term deposits.

| Number Of Shares/Units | Assets | Type | Cost (€) | Market Value (€) | IRR (%) | Abs.Perf. (%) (1) |

| 545 | Jeronimo Martins | Individual Stock | 8941.27 | 11041.70 | 6.67 | 8.32 |

| 15 | Berkshire Hathaway | Individual Stock | 3061.93 | 6416.81 | 16.97 | 109.57 |

| 342.6 | Alves Ribeiro | PPR | 6572.00 | 7085.14 | 3.23 | 6.81 |

| 386 | Vanguard FTSE All-World UCITS ETF (Dist) | ETF | 40485.87 | 54696.20 | 12.90 | 34.16 |

| 17 | iShares Core MSCI World UCITS ETF USD (Acc) | ETF | 1031.58 | 1896.01 | 12.97 | 83.80 |

| 168 | Vidrala | Individual Stock | 11452.54 | 15136.80 | 11.74 | 23.56 |

| 26 | Meta Platforms, Inc. | Individual Stock | 7523.97 | 14606.25 | 38.97 | 101.68 |

| 46 | Spotify Technology S.A. | Individual Stock | 5050.22 | 22734.18 | 59.83 | 350.05 |

| 880 | Dino Polska S.A. | Individual Stock | 7215.08 | 8620.71 | 10.35 | 19.43 |

| 91334.46 | 142233.8 |

- Absolute Performance = market value + sell/outbound deliveries + dividends – taxes – fees – initial valuation – buy/inbound deliveries. This calculation for absolute performance is limited to 2018 to the present.

The book value grew 13.80% in the last year, totaling €191 thousand.

| Metric | 2025 (€) | 2024 (€) |

| Book value | 191,035.05 | 164.675.63 |

Our book value has grown through three primary sources: savings from salary, portfolio returns, and the gradual increase in our equity in our flat through mortgage repayments. Historically, these sources have driven an average annual book value growth of 41.31%, although this year recorded the lowest growth rate to date. To sustain—or accelerate—this growth, we need to reinvent some of our existing sources and introduce new ones.

My near-term goal is to develop new sources of growth while rethinking the current ones. In 2025, we experimented with new initiatives such as freelancing and software development for a quarry. While the results have not yet fully materialised, they are expected to do so over time. As an early indication, approximately €1,000 of our book value growth this year can already be attributed to these efforts.

The following table presents the book value’s growth rate per year and calculates the average across all years combined.

| Year | % |

| 2018 | 41.10 |

| 2019 | 72.06 |

| 2020 | 35.09 |

| 2021 | 49.47 |

| 2022 | 19.48 |

| 2023 | 56.11 |

| 2024 | 41.18 |

| 2025 | 16.01 |

| 41.31 |

This year, to facilitate the true understanding of our financial health, I drafted our balance sheet. Please check the table below it.

| Line Item | € |

| ASSETS | |

| Non-current assets | |

| Investment in a jointly controlled asset (Flat – 50% ownership) (recorded at purchase price in 2018) | 58,750.00 |

| Right-of-use assets (IFRS 16) | 0.00 |

| Property, plant and equipment (IAS 16) | 0.00 |

| Financial assets – non-current | 0.00 |

| Other non-current assets | 0.00 |

| Total non-current assets | 58,750.00 |

| Current assets | |

| Cash and cash equivalents | |

| • Cash – savings account | 20,984.76 |

| • Term deposit (≤3 months, penalty-free) | 213.03 |

| Total cash and cash equivalents | 21,197.79 |

| Financial assets at FVTPL (Stocks + ETFs) | 135,148.66 |

| Financial assets at amortised cost (PPR) | 7,085.14 |

| Other current assets | 0.00 |

| Total current assets | 163,431.59 |

| TOTAL ASSETS | 222,181.59 |

| EQUITY AND LIABILITIES | |

| Equity | |

| Personal capital (Net worth) | 191,035.05 |

| Total equity | 191,035.05 |

| Non-current liabilities | |

| Borrowings – real estate loan | 28,230.54 |

| Lease liabilities – non-current | 0.00 |

| Other non-current liabilities | 0.00 |

| Total non-current liabilities | 28,230.54 |

| Current liabilities | |

| Lease liabilities – current | 0.00 |

| Borrowings – current portion | 2,916.00 |

| Other current liabilities | 0.00 |

| Total current liabilities | 2,916.00 |

| TOTAL LIABILITIES | 31,146.54 |

| TOTAL EQUITY AND LIABILITIES | 222,181.59 |

Every decision I make always focuses on following our long-term core strategy, which is centered on increasing “look-through” earnings. These earnings are derived from two main sources: salary and investments. The annual letter 2021 provides further detail on the concept and rationale behind “look-through” earnings.

As we enter the next phase of our journey, we have slightly adjusted the “look-through” earnings methodology. In addition to the traditional sources, we now include a new earnings stream from projects. This source, which is reported above, contributed approximately €1,000 during the year.

The tables below present a draft version of my “look-through” earnings. The figures are approximate rather than precise and are intended solely to illustrate the direction and magnitude of changes in earnings. Some items (for example, Net Savings) may differ from those shown in the 2024 table.

| Assets | Number of shares 2024 | EPS 2024 (origin currency) | EPS 2024 (€) (1)(2) | Earnings (€) |

| Spotify Technology S.A. | 46 | €5.5 | 5.5 | 253 |

| Jeronimo Martins | 545 | €0.95 | 0.95 | 517.75 |

| Meta Platforms, Inc. | 26 | $23.86 | 20.29 | 527.54 |

| Berkshire Hathaway, Inc. | 15 | $22.00 | 18.72 | 280.80 |

| Vidrala S.A. | 168 | €8.429 | €8.429 | 1416.07 |

| Dino Polska S.A. | 880 | PLN 1.535 | 0.3638 | 320.14 |

| Vanguard FTSE All-World UCITS ETF (Dist) | 386 | €6.24 | 6.24 | 2408.64 |

| iShares Core MSCI World UCITS ETF USD (Acc) | 17 | €4.25 | 4.25 | 72.25 |

| 5796.2 |

- $1 equals to €0.851.

- 1 PLN equals to €0.237.

| 2025 | 2024 | Delta (%) | |

| Gross Earnings (€) | 5796.2 | 5001.36 | 13.71 |

| Tax (28%) (€) | (1622.94) | (1400.38) | 13.71 |

| Net Investment Earnings (€) | 4173.26 | 3600.98 | 13.71 |

| Net Savings (€) | 19005.62 | 16446.30 (1) | 13.47 |

| “Look-Through” Earnings (€) | 23178.88 | 20047.28 (1) | 13.51 |

- The values differ from those reported in the 2024 annual report, as some figures were incorrectly reported at that time and have since been corrected.

This year, “look-through” earnings increased by 13.51%. All earnings sources—investment returns and savings from salary and projects—contributed in a balanced manner.

Maintaining this rate of growth becomes more challenging each year, primarily because salary, the largest contributor, has been growing at a slower pace. Potential solutions include salary increases or the identification of new income sources.

Ultimately, success or failure will be measured by the ability—or inability—to materially increase earnings sources over time.

Portfolio outlook

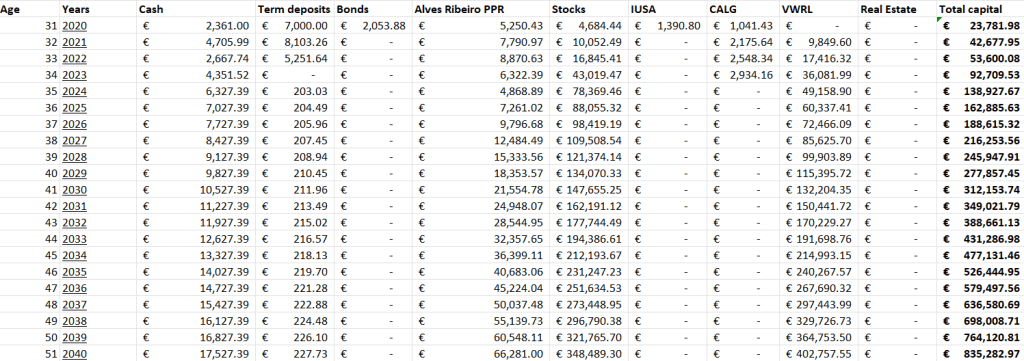

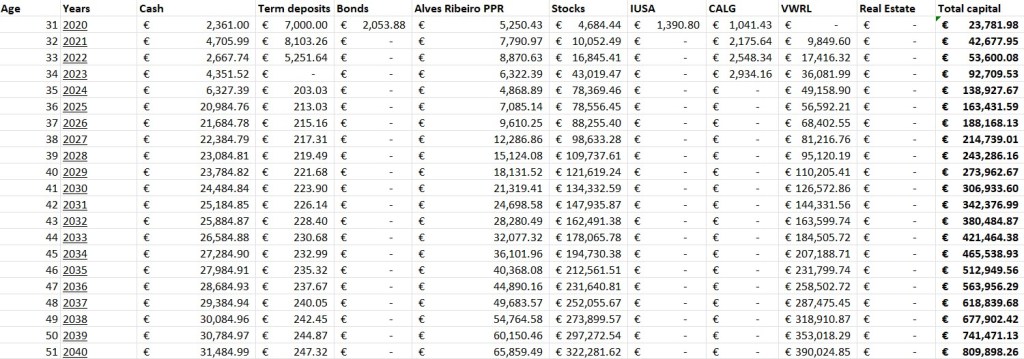

Finally, this section provides a brief outlook on the portfolio’s future. Based on this year’s results, we remain on track to reach a portfolio value in excess of €700,000 by 2039.

While this goal is achievable, it may reflect a degree of limited ambition. It may therefore be prudent to set—and actively pursue—more demanding targets. Why not make 2026 the year to aim higher?

In the coming years, I remain committed to exceeding these goals.